U.S. equity markets rebounded strongly last week as the “on again – off again” talks about another financial stimulus package came and went with the summer wind. Analysts had hoped Fed Chairman, Jerome Powell’s comments regarding how critically important more stimulus is would be enough to bring both parties to the table to reach a consensus. It seems gridlock still rules D.C. Stocks however, posted their best week since July.

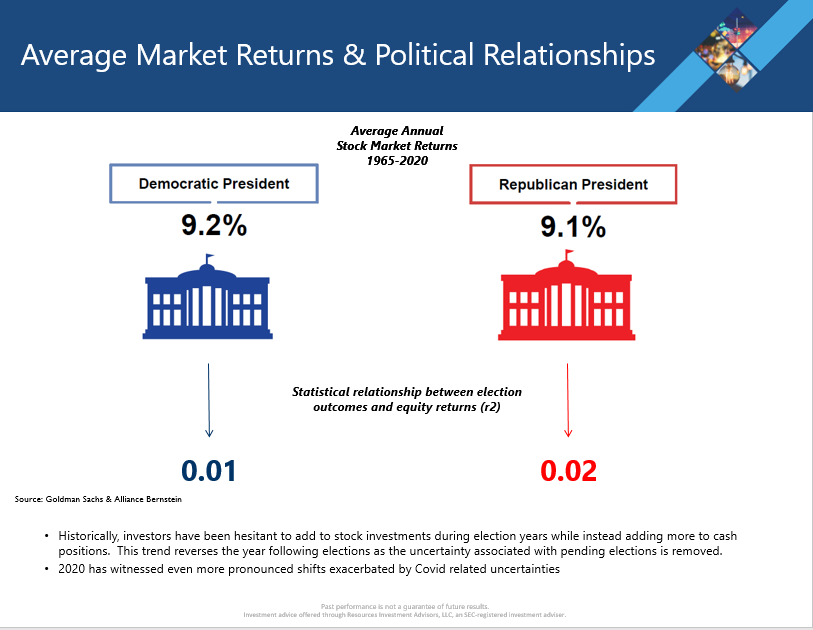

The one question I am asked most frequently by clients is, how do I expect the presidential election to affect the U.S. stock market? I’ve heard opinions going both ways. If Trump is re-elected, the markets will not take kindly to four more years. Or, if Biden is elected the markets will drop because he’s a Democrat. Regardless of what one’s political preferences are, let’s see what history teaches us.

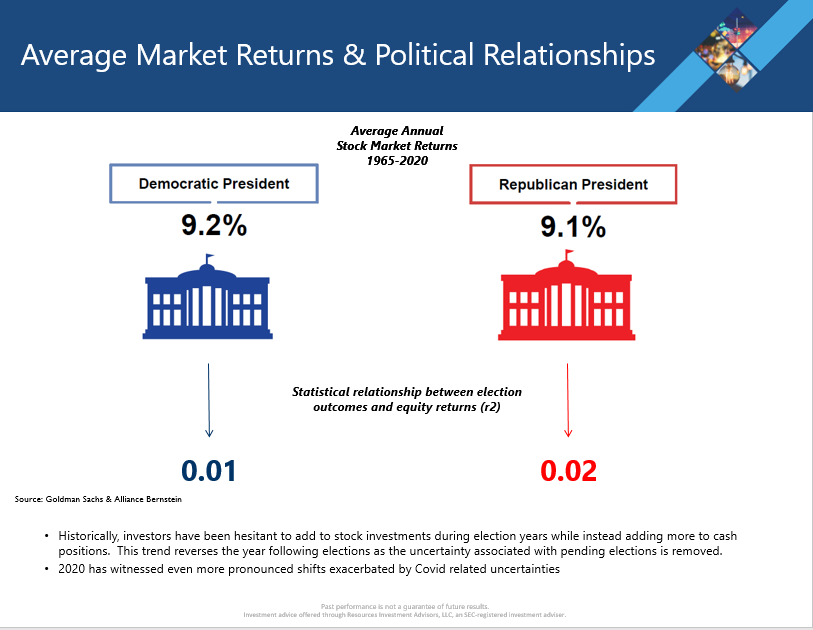

First, they say a picture is worth a thousand words. That was never more true than in the chart below. It comes from a piece written by Goldman Sachs and Alliance Bernstein. Contrary to what many people believe, the difference in market performance whether the sitting president is a Republican or a Democrat makes almost no difference at all. Looking back 55 years, the 0.1% difference even favors a Democrat sitting in the White House.

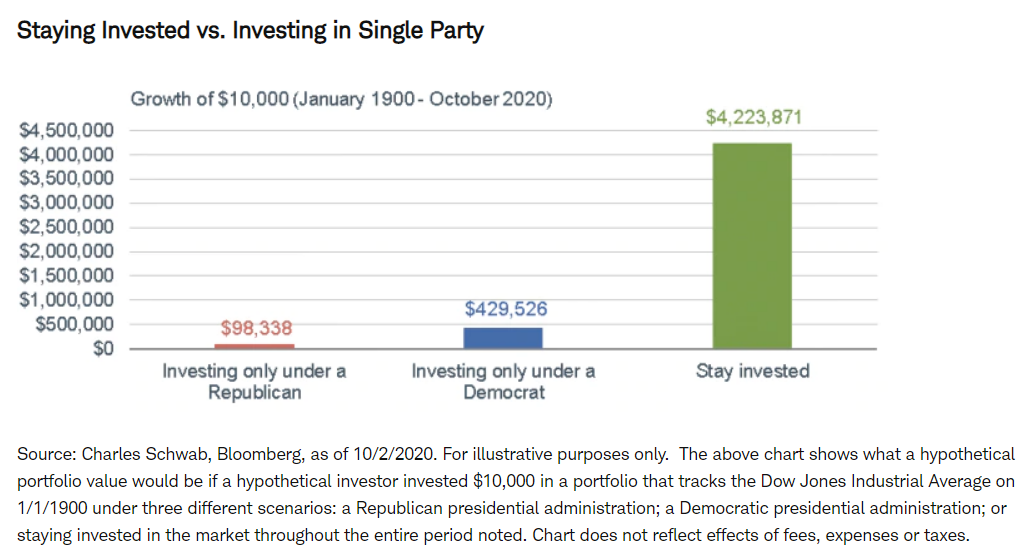

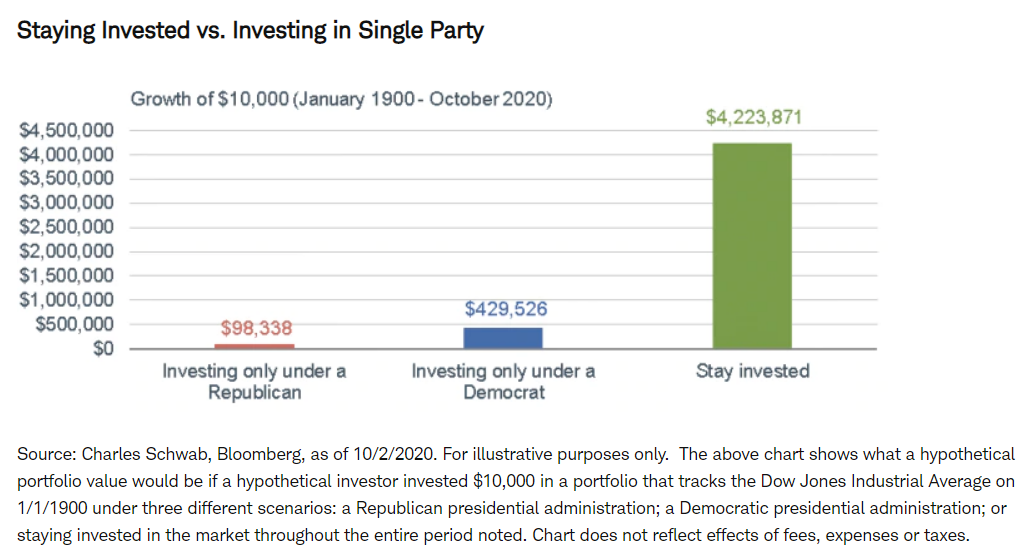

As important as that chart is, the one below is even more important, and just as amazing. We use the Dow Jones Industrial Average for our study because the S&P 500 didn’t exist before 1957. As you can see in the first two bars in the chart below, if an investor had invested $10,000 starting in 1900, but only had it in the Dow when Republicans were president, it would now be worth nearly $99,000. On the other hand, that same $10,000 would have grown to nearly $430,000 if it was invested only when Democrats were president. Seems like an obvious decision to make then? Not so fast. That same $10,000 in 1900 would have grown to more than $4.2 million if the investor had remained in the market the entire time, regardless of which party has presidential power. So regardless of who wins or loses, stay the course with your plan.

If you have any questions, please let me know.

The Markets and Economy

- The second-largest cinema chain in the U.S. is again closing all of its locations nationwide after reopening in August. Regal Entertainment Group’s decision affects more than 500 locations and follows a cascade of postponements for big-budget movies. Most recently, the 25th installment of the James Bond franchise (No Time to Die) has been moved for the second time from early November to April 2021.

- Unemployment claims in the U.S. fell slightly to 840,000 the previous week. Analysts are concerned the claims have stubbornly stayed in a range between 800,000 and 900,000 for more than a month. A sustained job recovery is crucial to the economy fully recovering from the effects of the pandemic.

- The Institute for Supply Management’s non-manufacturing index, a survey-based measure of activity in the U.S. service industries such as restaurants, real estate and health care, rose to a reading of 57.8 in September from 56.9 posted in August. Globally, service industry companies are recovering more slowly than those in the manufacturing sector.

- China’s fast recovery from the coronavirus pandemic helped power a large stock market rally over the summer months. In early July, the Shanghai Composite Index jumped nearly 17% in less than two weeks. Chinese stocks have fared better than their U.S. counterparts for much of 2020.

- According to a survey by the Employee Benefit Research Institute taken in January of this year, 31% anticipate they would retire at age 70 or later.

- Even though crude oil is produced in 32 U.S. states, just 2 states (North Dakota and Texas) are responsible for 52% of the nation’s crude oil production.

- More good news on the consumer imports front. Trade picked up over the last few months as the U.S. imports of consumer goods returned to pre-pandemic levels. Also, the Managing Director of the International Monetary Fund said the global economy won’t contract as much this year as the IMF had predicted in June.

- Fed Chairman, Jerome Powell warned of potentially catastrophic consequences if Congress and the White House don’t provide additional support for households and businesses disrupted by the pandemic. “The expansion is still far from complete,” the chairman said during a virtual conference of private-sector economists. These are the strongest remarks to date on the subject.

- OPEC expects demand for crude to fall more than 10% among the world’s richest economies this year. and says it may never return to 2019 pre-pandemic levels.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.